Building in the real world is difficult. Investing in progress is risky. It seems easier to try and protect your successful past investments than to find new markets and compete for new profits. Amazon’s recent investment to build small modular nuclear power reactors should be a proud moment for American tech companies to rally around. Let’s talk about that moment and why it should be a wake-up call for the rest of Big Tech to start spending their profits on the clean energy future before they fall behind while trying to protect their lead.

Amazon is ready to build

Amazon has historically had no hang-ups about keeping margins high. The company culture has always been about Day 1, and from the outside, it takes this value seriously. In summary, a Day 1 mentality is similar to a growth mindset in that you make big bets and learn from failures. The moment the company attempts to protect its lead instead of obsessing about its customers, it has reached Day 2 which Amazon considers a death sentence. Anecdotally, this can make Amazon a stressful place to work because an employee can end up in a position where making an impact is difficult or impossible, leading to them being terminated despite putting in long hours. This tradeoff enables Amazon to keep building new businesses at a rapid pace considering its enormous size.

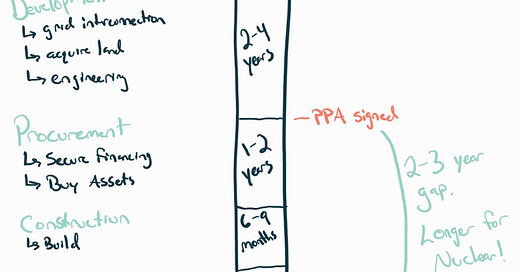

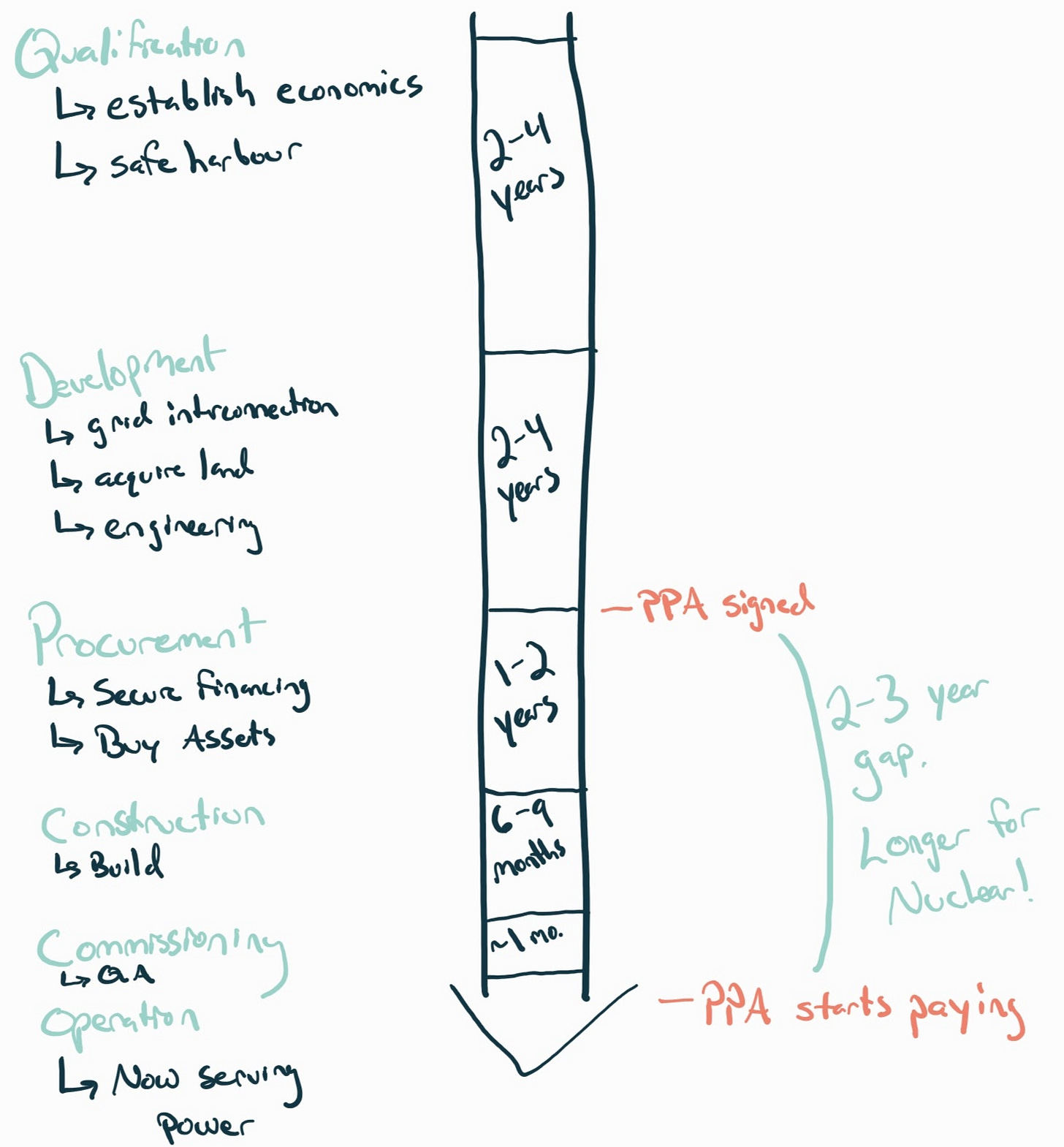

Operating income at Amazon fluctuates wildly for a company of its size because of this mentality. In 2022, Amazon generated $12B but in 2023 that number exploded to $36B when its ads business took off and created a positive feedback loop with online sales volumes. Now Amazon is looking for new horizons. Amazon already executes far more PPAs than any other company in the world. With almost 10GW of capacity purchased through 2023, it has already hedged its clean power bets well ahead of other tech companies with net-zero aspirations who purchased less than 4GW through the end of 2023.

Microsoft made headlines last month when it made a power purchase agreement (PPA) for electricity that will eventually be generated at a restarted Three Mile Island reactor when it comes online toward the end of the 2020s. Amazon doubled down on nuclear power by agreeing to invest $500M to develop and construct small modular reactors near several of its data centers. This is a stronger commitment to the clean energy future as Amazon would partly own the reactors (and the associated risk that they are not built), reaffirming its belief that small modular nuclear can be profitable in the United States on some timeline. Amazon is putting its profits to work on the problems its business faces concerning electricity consumption. This helps nuclear developers who have been starved of capital for decades, shows good faith that the public sector can use to help backstop potential cost overruns, and continues showing Amazon’s customer obsession by working in the real world to solve the most critical problems of the day.

Google’s clean energy hedge

In 2016, Google posted a story on the corporate sustainability website on its viewpoint with respect to renewable energy purchasing:

In 2009, our data center energy team began to study power purchase agreements (PPAs): large-scale, long-term contracts to buy renewable energy in volumes that would meet the needs of our business. The idea behind using a PPA is simple: Google can’t buy clean energy from our utilities because of regulatory restrictions on our retail contract, and we can’t produce nearly enough of it behind the meter at our data center facilities because of physical and geographical restrictions. But we can buy it at the wholesale level directly from developers on the same grids where we operate our data centers.

From a physical perspective, this is just as good as consuming the renewable energy directly. That’s because electricity on a grid is fungible; electrons generated in one spot can’t be directed to any specific user on the grid, any more than a cup of water poured into a river could be directed to a particular stream. So it doesn’t make much of a difference where the renewable energy that we buy is located, as long as it’s on the same grid as our data center.

An update late in 2023 indicated innovation in making these PPAs come through faster by streamlining the proposal process. Executing PPAs faster is great for Google because it doesn’t matter where the electricity comes from as long as it is somewhere on the grid. Just find the lowest price offered by a solar farm and Renewable Energy Certificates will get to that net zero goal. The problem is Google is living in a fantasy world when it comes to these investments.

Google Executive Ben Sloss said to the Associated Press about Google’s largest energy purchase to date:

This project was a spreadsheet and a set of emails that I had been exchanging and a bunch of approvals and so on. And then you come over the rise over there and you see it laid out in front of you and it kind of takes your breath away, right? Because there’s this enormous field of solar arrays,” Sloss said during the ceremony. “And we actually collectively have done this. That is amazing.

A PPA is a small step toward net zero, but it is a hedge from Google’s perspective. Other investors still have to finance the construction of the solar array, wind turbine, or nuclear power plant. Solar is a clear market winner already, so Google’s solar PPAs are not exciting or innovative. As Sloss says, it is a sensible calculation on a spreadsheet. Meanwhile, Google’s “other bets” line item loses over $4B annually so their software engineers can angle for promotions by applying “AI” to problems with solutions that never see the light of day. Not to worry though, Google as a business generated $95B in operating income in 2023, and parent company Alphabet still saw $84B over the same time. Someone else can figure out where to find a few billion dollars to finance the small modular nuclear reactors and Google will happily buy the power at market rate once they are online. If the reactors aren’t built, Google can shift the blame to the power sector and claim it is ready to purchase clean energy when it becomes available. Until then, Google will keep funding science projects that go nowhere on the back of ad revenue generated from the business it created more than 20 years ago rather than risk its margin profile bringing down its stock price. This is why Google was late to the public cloud game and Amazon won the big prize with AWS. Maybe Amazon will share some of its new nuclear power with it when Google needs it.

Microsoft, Apple, and the rest

Google is easy to pick on because it has been loud lately its AI lead slips away to competition and chat interfaces threaten the search ads business in the long run. It’s worth noting that every other Big Tech company with a net-zero commitment operates just like Google, often at a smaller scale. Meta has been most committed to PPAs behind Amazon at around 4GW. Microsoft and Google have committed less than half of what Meta has in terms of PPAs. These companies all own massive data center footprints that need 24x7 power and it is worse for them to do nothing than for them to execute PPAs.

Data center power usage may be growing but it is far from the most energy-intensive operation in the world both in terms of absolute power consumption and efficiency of power used. Industrial applications are brutally inefficient in terms of waste heat and building physical widgets will always take more energy than moving electrons through a circuit board.

That brings me to the world’s largest hardware company: Apple. Apple has built an excellent corporate sustainability brand on the back of its headquarters with solar panels on the roof and a rabid fan base eager to believe that their iPhone was built without coal. In reality, Apple builds all of its devices in China through subcontractors that it can lean on but not control. Despite China making gains in renewable electricity generation, it is the biggest polluting country in the world by far due to its (waning) dependence on coal and large industrial base. Apple contributes $4.7B to purchase Green Bonds to offset emissions but has a steep hill to climb before its business is “clean”, especially with a planned obsolescence strategy that requires its customers to purchase ever more devices.

There is a vast amount of capital held in the coffers of these extremely profitable Big Tech companies. It would be great to see more of them adopt a Day 1 mentality and invest in building real-world assets directly to support their business rather than waiting to see what ends up at the top of the spreadsheet.