Clean Hydrogen Hubs - Winners and Losers

The definition of "clean" will make the market for hydrogen

The Bipartisan Infrastructure Law provisioned $7B in funding for between six and ten regional clean hydrogen hubs across the United States to create the framework for a more developed hydrogen economy. Bootstrapping a supply chain is an enormous undertaking and the first steps can create winners and losers right away. For hydrogen in the United States, the winners and losers will be determined by how these hubs define “clean”.

Not all hydrogen is equal

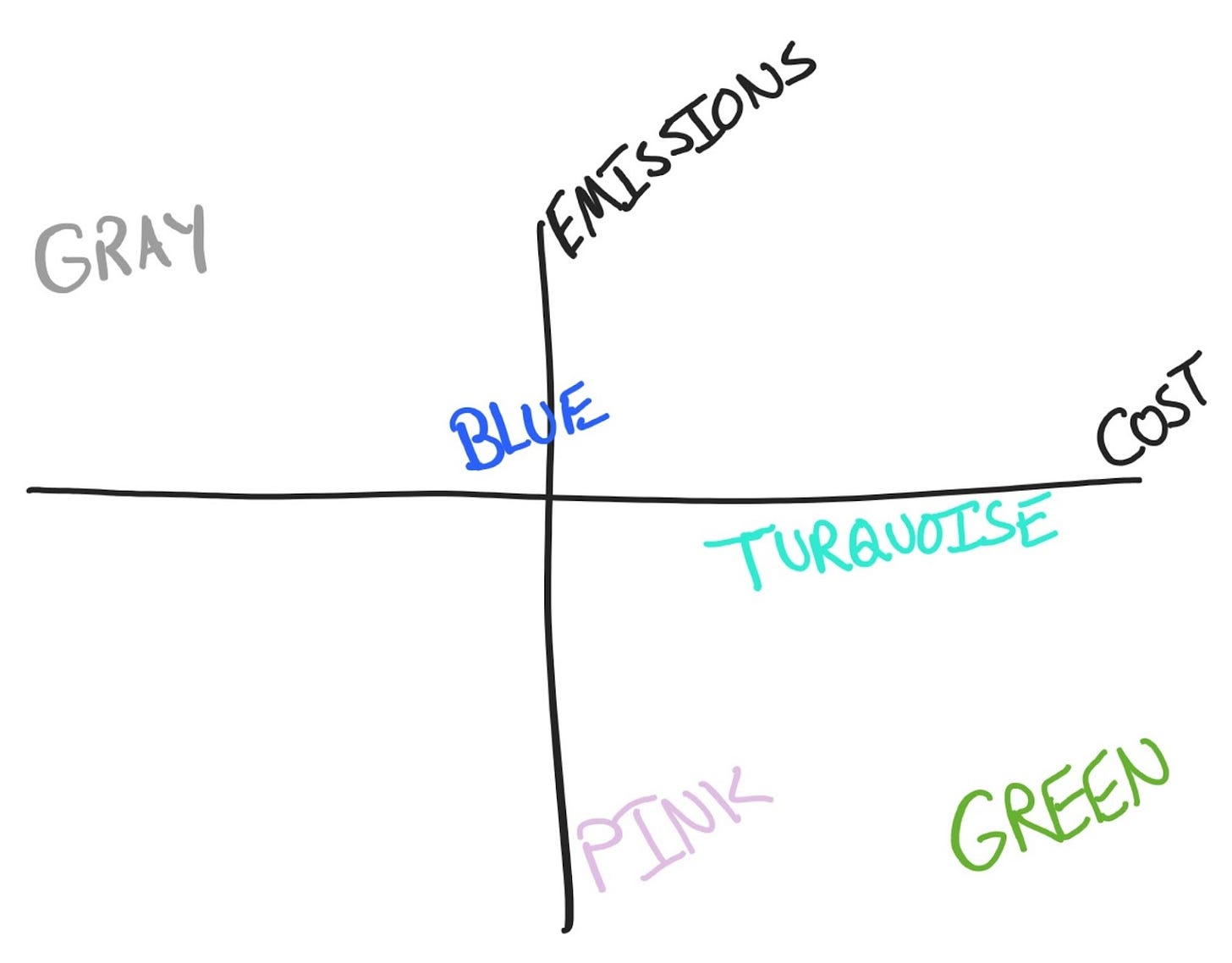

Hydrogen can be extracted in many different ways. The industry refers to colors that describe how the hydrogen was sourced. Here's a rudimentary 2x2 showing the relative emissions and costs based on color code:

Below the line is what is considered "clean" by the standard. Each kilogram of H2 produced must have a lifecycle emissions rate of less than 4 kg of CO2 equivalent. That means there are 4 hydrogen extraction methods that qualify today:

Green - derived from electrolysis using renewable energy

Turquoise - methane pyrolysis produces hydrogen and solid carbon byproduct

Pink - derived from electrolysis or thermolysis using nuclear energy

Blue - steam-methane reforming with additional carbon capture to reduce emissions and meet the standard for clean

The goal of these hubs is to incentivize cleaner extraction processes and flood the market with lower cost hydrogen that comes from verifiably cleaner sources. No matter how it is extracted, hydrogen is also used in a wide array of applications from chemical production to food processing to making steel. These hydrogen hubs will apply to all of the existing use cases and new ones coming this decade including heavy transportation and electricity generation. That means that "clean" hydrogen will have to compete in the general hydrogen market and get to scale if it is to succeed alongside existing gray hydrogen sources. This is tricky considering gray hydrogen sources are similar to blue but without the additional tax that comes with carbon capture.

Winner - Natural Gas Producers and Processors

It looks like natural gas extraction is a winner regardless of the definition of “clean”. The world’s largest hydrogen producers today are companies like ConocoPhillips, Linde, and ExxonMobil because they extract hydrogen from natural gas using steam-methane reforming. While natural gas continues to grow, oil and coal plants don’t have new significant investments coming on the horizon. Additionally, demand for gasoline likely peaked in 2019. It makes sense for these companies to continue to dominate the hydrogen market as new use cases arrive, but they will need to implement some method of carbon capture and storage to use steam-methane reforming if they are to count as “clean”.

I’m not sure it matters if they count as “clean” or not from a making-money perspective. Data from the Energy Information Agency (EIA) shows that planned new generation in the next two years is dominantly solar power and it isn’t even close (please visit enersection.io for more of these beautiful charts!).

Battery storage is a clear second place investment area and that’s what these companies need to prevent from taking too much market share in the long run if they are to dominate. Fossil fuels are energy stored from millions of years ago, and a wholesale move to generating and storing energy without needing fossil fuels at all would be a death blow. However, a clean hydrogen policy can change with a new government regime. If I were running a large fossil fuel and chemical derivative company, I would happily concede ground on the definition of what is clean right now in order to ensure hydrogen was a key player in energy storage going forward, especially while I try and play catch up on extracting lithium to make batteries and diversify.

Winner - Experimentation

The prospect of government subsidies in the future and some upfront capital to do some pilot projects has led to some nice experimentation with generating clean hydrogen. Duke Energy, which notably wasn't selected as one of the participants in a clean hydrogen hub, has announced a pilot project to convert one of the four generators at the Debary power plant to burn hydrogen instead of natural gas. That hydrogen will be sourced from electrolyzers that are to be powered by the nearby solar farm. It's a modest start, with only 2 MW worth of hydrogen production capacity and a 2,500 kg storage tank, but it's going to take only 20 workers until the end of 2024 to bring it online. That's extremely quick in grid change terms and gives me some reason to think that if it is a profitable endeavor, this could snowball as a solution to decarbonization for utilities in a hurry. A drop-in solution for zero-emissions peaker plants would be astounding.

One thing that wasn't clear from this announcement from Duke Energy was who is building the electrolyzers that will be put to use. There are plenty of manufacturers out there that will make a hydrogen electrolyzer, but Bloom Energy bets their business on this technology becoming a mainstay going forward. We haven't really seen the market respond with optimism about their prospects lately, possibly owing to their 2023 push for profitability. If these sorts of utility level experiments with green hydrogen replacing peaker plants start heading to production, I'd expect Bloom Energy to be one of the most direct indicators that real movement is happening in this space. Plug Power is another potential indicator, although their story is a bit more complicated and deserves its own separate article altogether.

Loser - Nuclear Power

From the DOE’s report on hydrogen strategy in 2020:

“Hydrogen production cost through electrolysis at a centralized station is estimated at $5/kg to $6/kg with electricity from nuclear or wind resources. Hydrogen from zero-carbon electricity, such as nuclear or wind, is 2.5-4 times more costly than hydrogen from carbon-neutral or net-negative carbon fossil resources”

This outlook has continued over the last several years and it’s clear with funding choices that this is going to be brutal for an already beaten down nuclear energy market. Nuclear sourced hydrogen is being told that it isn’t part of the picture at all. Existing nuclear plants could be run at higher loads and have their excess power generate hydrogen via nuclear thermolysis at ~$2/kg, but it would appear the DOE is uninterested in this path. The technology isn’t ready for production at scale after 20 years of research and development, and that means another nuclear advantage is off the table for now. That's reflected in the funding allocations as well. Energy research and development funding hit a record high in 2022, and for the first time ever, hydrogen funding hit $3B. This is close to the range nuclear research funding has been at since 2014. It's no wonder that Westinghouse, the major nuclear reactor component maker in the United States, has shown interest in promoting the hydrogen production use case over the years. They just haven’t been able to execute even with billions of dollars heading their way over the past several decades, which has been an unfortunately consistent story with nuclear since the 1970s.

Thank you for shedding light on the hydrogen hubs. Do you have any recommended resources to learn more about how hydrogen can be used for battery storage?