What makes Tesla work

Tesla is always a news item, but let's talk about how Tesla's business works

At the beginning of the year, I said I would be doing some company deep dives and we're here! Tesla has of course been analyzed repeatedly, but I think much of the focus has been on the personality of the CEO for good reason. Regardless of how you feel about Elon Musk, Tesla has been a success story for American manufacturing, climate positive business, and the belief that big ideas can make big changes. This one is going to be longer than usual, so if you need to grab a cup of coffee, I’ll wait until you get back!

Durable advantage

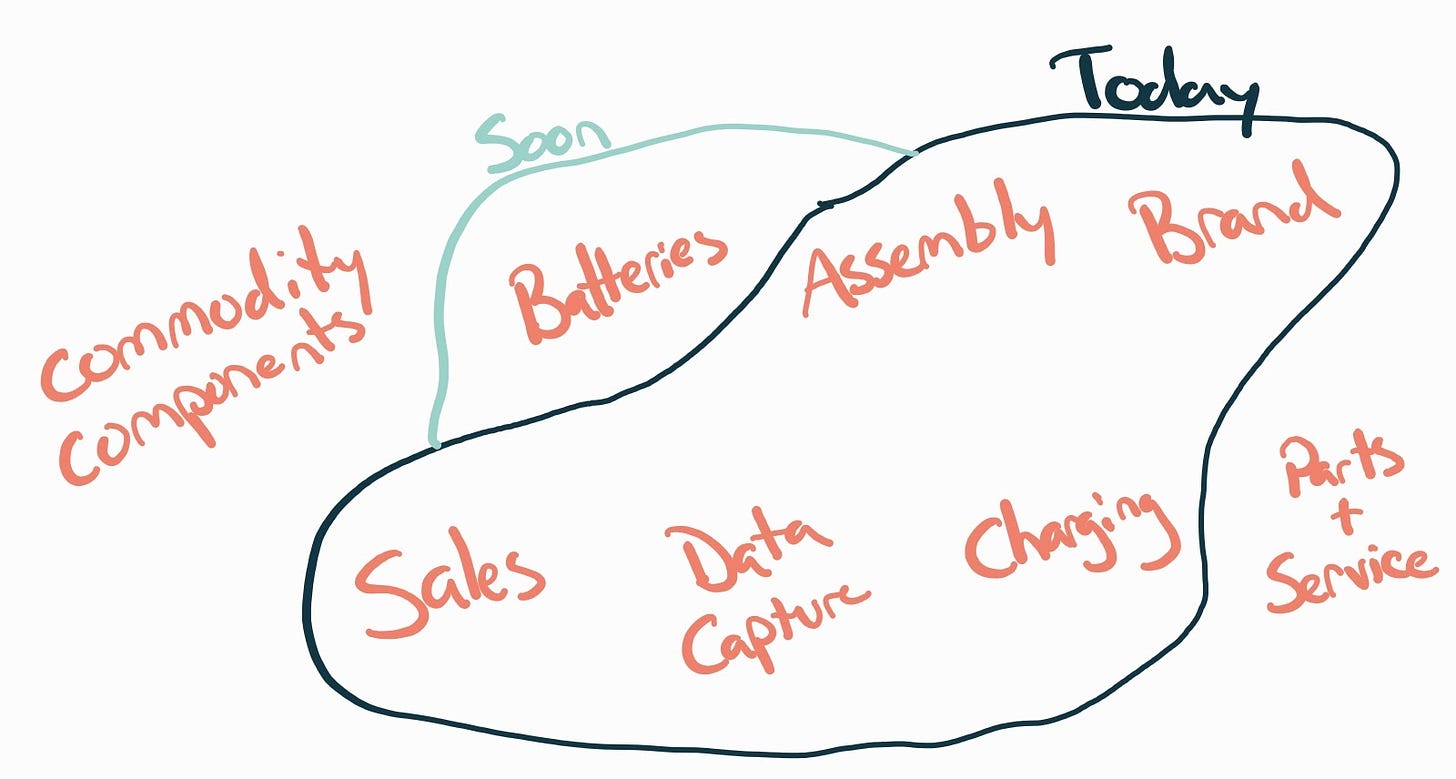

Tesla is integrating different parts of the value chain than traditional carmakers when it comes to EVs. Tesla has integrated charging, sales, and looks like they will head for batteries at some point in the future. They do parts and service as a necessary evil. Other carmakers who sell in the US focus only on assembly, parts, and brand. This leaves the dealerships to take care of the rest. Tesla ends up looking more like this:

There are two major EV makers globally, BYD and Tesla. There are statements from large players in gas powered vehicles about making the move to EVs, but as I’ve explained previously, this is going to be a long and painful process if they can ever get there. Upstarts like Rivian and Polestar have some backing, but they miss one key point: they are car companies. Tesla, like BYD, is an energy storage company that also makes cars. Tesla has become an expert supply chain manager for batteries as they have reached a scale that allows them to diversify their suppliers and drive down costs. This wasn’t always the case, but at the end of 2020, Tesla hit a scale such that suppliers started to want to get in and Tesla warped the industry through its gravity.

That scale was about 500,000 cars being delivered in 2020 and a promise of 1,000,000 in 2021. In 2024, only VW has been added to the list of companies delivering 500,000 EVs in a year. Stellantis and Hyundai could have a run rate of 500,000 annually by the end of 2024 but even with flat growth on the production line, Tesla is quadrupling that pace. The other companies are more interested in trying to control the narrative than trying to make EVs, only falling further behind.

Direct sales are another area of huge advantage. Tesla employs everyone who sells a new Tesla to a customer. They don’t need to convince a car dealership owner who is worried about how they will be able to charge these cars when their utility has told them they can’t get a new transformer upgrade for 3 years so they can only put in one fast charger. Even if they have electricity figured out, there may be concerns about post-sales services revenue opportunities or complicated political feelings to navigate. Tesla has no such issues to overcome.

Finally, there’s the charging network. Other carmakers have already admitted defeat here by agreeing to adopt the NACS standard. Many people mostly charge at home, but if there’s money to be made with home charging, Tesla has the advantage there too as the standard bearer for NACS. Then there’s the business of people charging away from home:

Stock price isn’t everything but the last year certainly looks like the largest publicly traded charging networks are firmly in undifferentiated territory and headed in the opposite direction of America’s biggest EV maker. Even more critically, Tesla gets the data on charging from anyone charging with their chargers (at home or not) and from cars on the road, giving them a further advantage in understanding user behavior to put into their next generation of cars. Meanwhile, everyone else has to make mistakes so they can tease out the stated versus revealed preferences of their users. Remember too that car model refreshes take years on the calendar and millions of dollars to roll out, so experimentation is slow and expensive. Knowing what to build next based on usage data prevents expensive mistakes in design. No one other than Tesla who sells EVs in the United States has an at-scale dataset so they must rely on market research and focus groups.

Where Tesla could struggle

So if Tesla is the 800 pound gorilla to battle, one option is to make a combined effort to grab market share in the United States. BYD isn’t going to be making inroads any time soon given United States tariffs against China and that complicated political landscape. Ford divested itself of Rivian so it’s unclear that they are interested in making a partnership go. Same with Honda and GM’s partnership prospects. The anti-Tesla alliance doesn’t look to be happening, but if we start to see some partnership or consolidation, it could be a threat to Tesla.

The biggest threat to Tesla is a misguided foray into robotics. From CNBC:

Musk described Optimus as, “something that I think has the potential to far exceed the value of everything else combined,” for Tesla. He claimed that Tesla’s technology developed in its automotive unit translates well to the humanoid robot “because the car is just a robot on four wheels.”

Musk also described Optimus as “by far the most sophisticated humanoid robot that’s being developed anywhere in the world.” Competitors in the market include Boston Dynamics, Agility Robotics and Figure. Other robotics companies like Sanctuary, Apptronik, 1X, Fourier and Unitree are all working on dexterous manipulation hardware, mimicking human hands.

Robotics isn't what Tesla does and I think this is a distraction. It can be the CEO’s pet project, but if it becomes a significant expense to the business, I think it ends up looking a lot like Zuckerberg's obsession with the metaverse. Sure, it could pan out a long time from now, but the massive opportunity in front of Tesla on both the EV and energy fronts would suffer from pouring resources into robotics and AI endeavors.

Finally, Tesla could go too far in price reductions for EVs and end up pushing out luxury customers for their brand. Walking the line between keeping luxury while getting everyone access to your products is difficult but we can look to Apple for what that model looks like. Apple goes downmarket by continuing to make older models on depreciated production lines. The key is they always have the next big thing in their newest phone models, meaning you always need that next big thing for this to work. To demonstrate just how tricky this is, Apple struggles to go downmarket with every product that they have other than the iPhone, but for more than 15 years they have gotten it right with the iPhone. Maybe cars are different and the luxury brand can have affordable cars as well, but there's a reason that Toyota has Lexus as a separate brand.

Tesla’s 2023 earnings

I am no stock analyst, so I'm not going to attempt to rationalize the ~10% drop Tesla stock took after reporting earnings last week. However, the earnings call gave a key insight into the future of production at Tesla, and I think the stock market either didn't listen or didn't trust the guidance being set forward. 2023 production and deliveries of vehicles were in line with expectations at 1.8M cars, with 1.2M of those being the best selling in the world, Tesla's Model Y. Having growing popularity and setting a predictability bar as they have, tells me they should get a bit of leash for the statements about needing time in 2024 to switch to a new manufacturing process to ramp up better production rates going forward. Scale horizons require new technology and processes to avoid inefficiencies in the long term. This is a good thing but I'm seeing analysts punishing Tesla here. That's going to be shown to be a mistake as I don't expect Tesla to lack the fortitude to push through to get to the other side of the new process.

I thought it was notable how much time Tesla spent thanking suppliers. This is a nod that I haven't been seeing in other car manufacturer earnings calls, and I don't think it is just some level of politeness. This emphasis I think is more to advertise to other potential suppliers that they are actively good partners and keep pressing down the cost curve by adding more supplier redundancy. Karn Budhiraj, VP of Supply Chain, said on the call:

As we introduce new products we have the opportunity to go renegotiate existing suppliers for better pricing. We're looking at every penny like Vaibhav and Elon mentioned. Just to give you an example, our inbound logistics cost has come down by 22% year-over-year. And this is because of optimization on using returnable packaging as opposed to cardboard, which is even better for the environment, optimizing trucking routes, negotiating beter pricing with shipping companies, going with full truckloads and just doing that, sort of. The bigger we become, the more we put thought into these things and the more efficient we become as a result of it. So those work streams are going to continue.

This is attention to detail that you just don't see from other carmakers on their supply chain anymore because those efficiencies were squeezed out decades ago. Not only do carmakers who lose billions selling EVs have a long way to go, but Tesla can probably keep coming down the cost curve for several more years just through better supply chain management. That's good news for lower priced EVs and bad news for companies who already are losing money trying to play catch up.

Finally, the big story from earnings for me is the continued growth in energy storage and generation. We've heard what a big year it's going to be for utility scale battery deployment and Tesla went from $3.9B to $6B in revenue on these products in the past year. Tesla didn't offer any official guidance that I could see on what that number will be in 2024, but I would watch it closely in Q1's earnings. If they are winning the contracts to build utility scale battery storage, but it's carmaker and technology analysts covering them, there could be a completely skewed perspective on the forward possibilities of this business. I think it is an underestimate.

Final take

Tesla is the most successful company to date in terms of taking advantage of the opportunity to rebuild existing markets for a world where carbon and emissions have a cost. They have shown to be a disruptive force that is just now getting to the scale where existing players are trying to respond thoughtfully. They are largely protected from their biggest competitor in China, so they will have the opportunity to continue growing their impact if they can stay out of their own way.