Regional electricity market power plays

Oversight of each electricity market plays an outsized role in how renewable energy will be deployed

Today, I’m revisiting the implications of passive energy collection versus fuel based electricity generation on the electricity market. Electricity is not sold in a free market and the way different regions regulate has a huge impact on the deployment of new generation sources. Florida may see more microgrids pop up, North Carolina is steering toward keeping a transmission monopoly while dropping generation, and Texas may beat everyone to a grid that’s ready to be 100% renewable.

Buying and selling electricity

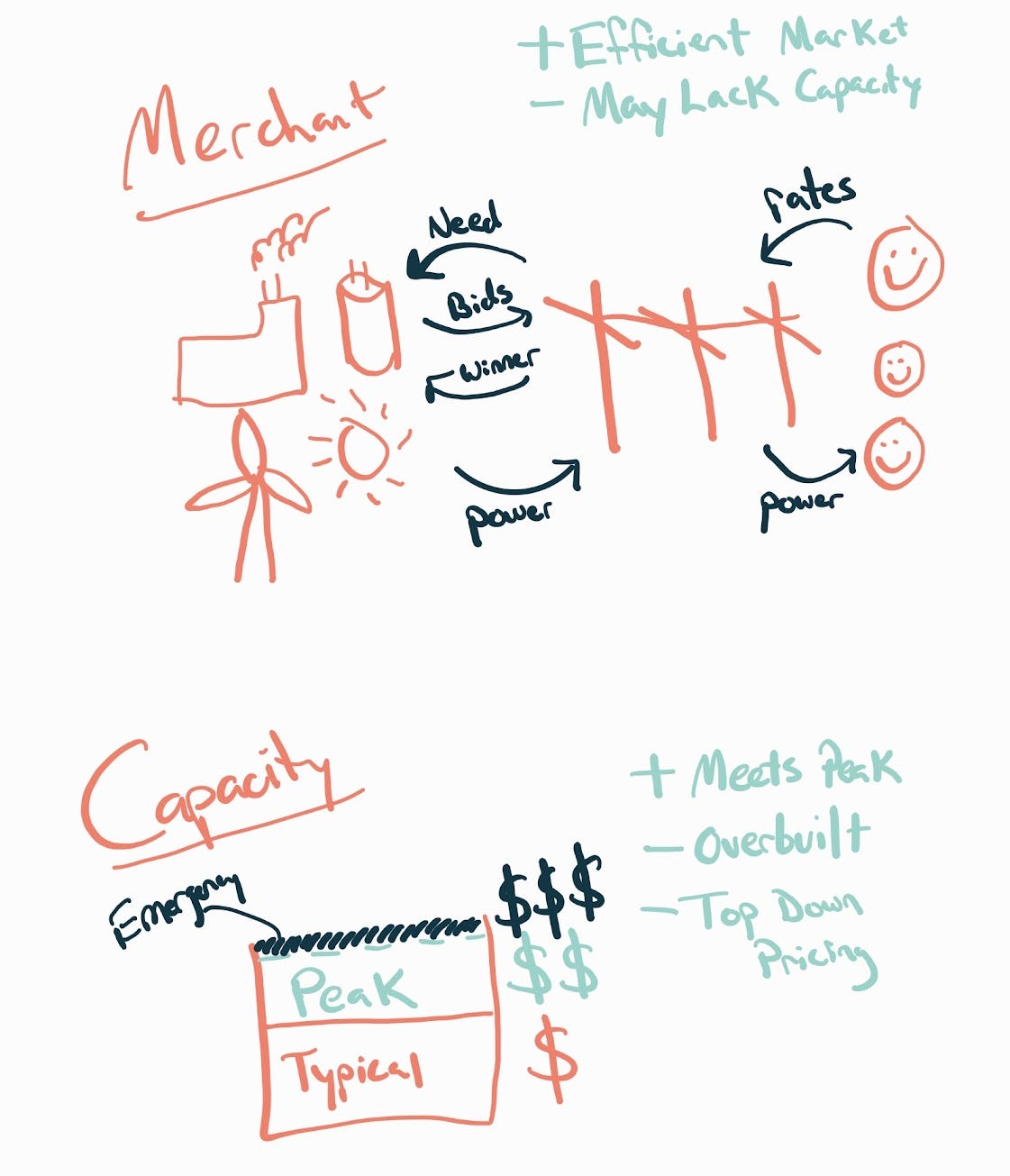

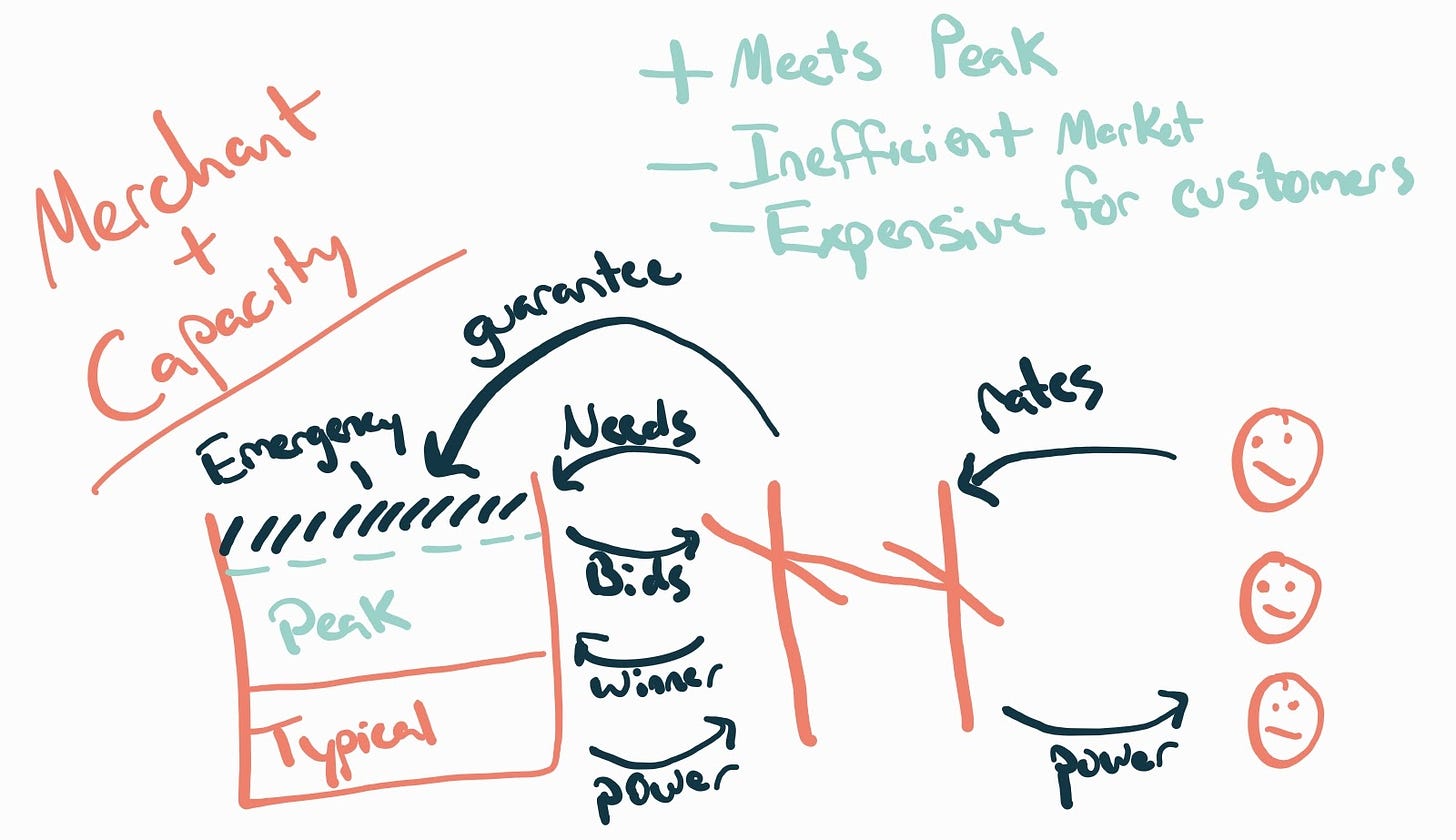

The electricity market in most places in Europe and the United States includes both a merchant market and a capacity market. Merchant markets look to match generated electricity with buyers on the grid as a wholesale electrical market. The buyers predict demand and generators bid to service that demand with their supply. Capacity markets work on a reserve capacity system where grid operators pay upfront for a generator’s capacity, whether or not that capacity ends up being used. Each looks something like this:

Put another way for the readers familiar with software-as-a-service, a capacity market is selling reserved instances versus a merchant market selling on-demand instances in AWS. When these two concepts are put together, you end up with feedback loops that optimize to meet peak load under the most possible conditions. However, this happens at the expense of the efficiency of the market, resulting in generally higher prices for customers as they pay for resources that are not utilized.

In the United States, every regional grid operator except for ERCOT (Texas) has both market types. Fuel based sources are best suited for a capacity market where they can get a guaranteed rate to cover the cost of keeping a plant operational, even if they don’t need to generate power on a given day. With both a merchant and capacity market available, a fuel based plant gets to have both guaranteed operational expense and the capability to cover marginal fuel costs as fuel prices fluctuate.

Utilities feel the solar heat

To start November, I wrote about the problem investor-owned utilities are starting to feel with both a need for big projects and the decentralized nature of rooftop solar installations eating into both their top and bottom line. In Europe, the future is now where Disneyland Paris has nearly completed building a solar canopy to cover its 11,200-space parking lot to both generate electricity that helps offset their operating expenses and gives a new selling point to guests who don’t like walking through a huge parking lot in the rain or without shade in hot weather. One of the blockers to making this happen in many places in the US is zoning. In New York City, solar canopies were not allowed in many parking lots because they were not permitted obstruction to open space. This restriction was removed at the end of 2023 as one of 16 proposals adopted by city council to improve city sustainability. Notably, this was the only proposal that required a single slide. 8,500 acres of space are now opened up to put in solar canopies, which is a great land use win but also an economic opportunity for the owners of these lots to find new revenue streams.

Those new revenue streams are coming at the expense of investor owned utilities. This fact is starting to dawn on investor owned utilities who at first appear to be oblivious to the realities of modern power generation. From the Washington Post:

A spokesperson for Florida Power and Light declined to say whether the utility is in talks with Hunters Point about the idea but said it would face obstacles from the Florida Public Service Commission, which regulates big public utilities in the state.

Asked about the matter, Cindy Muir, who heads the commission’s Office of Consumer Assistance and Outreach, said in an email, “We’re not familiar with the term ‘virtual power plant;’ and thus, we have no rules defining that term.”

This excerpt is from an article talking about a neighborhood in Florida where all of the homes have solar and batteries to provide resilient and zero marginal cost power to residents, a model for housing developers that I’ve talked about before. It’s laughable that a utility wouldn’t be familiar with the term ‘virtual power plant’, but they clearly are disinterested in giving credibility to the idea. Down the Florida panhandle at Alabama Power, the utility has been funding news outlets to ensure stories put a positive spin on their environmental issues and make sure status quo remains as long as possible. In South Carolina, Dominion Energy has said they are fine without serving data centers, one of the largest electricity consumers of all, because many data centers have clean energy requirements that they just don’t want to get involved with. These are actions of desperate companies trying to delay action while they figure out what they can do to steer the situation in their favor.

Speaking to the localized nature of the energy transition, not all utilities are handling the new reality of their business the same way. Duke Energy has decided to embrace the process and in exchange for becoming a more transmission oriented utility, they are hiking rates. The money will be used for building out storage, improving interconnection times, and a healthy new profit margin. There are ethical implications of any rate hike, especially on the lowest income households, but the business strategy is smart from Duke Energy here. Bloomberg is predicting that the stock market will be paying close attention to grid operators’ ability to build out transmission. By building transmission, while the money is available, they disincentivize businesses to look into microgrids and virtual power plants that will eventually challenge their monopoly status. The gas plant shutdowns are already here, renewables are taking over, and storage buildout is eating away at peaker plant utilization faster than anyone would’ve predicted a year ago.

Optimism in deregulated Texas

Solar and wind are both difficult to sell in a capacity market as they are intermittent energy sources that don’t provide consistent base load. They are much better suited for the merchant market where their essentially zero marginal cost makes any power they provide extremely competitive. Storage solutions are great for the capacity market as they have lower operational costs than fuel based plants but have a guaranteed capacity that can be charged when merchant rates are low as a consumer. This gives them the capability to arbitrage the electricity market in a way that no other solution really can. That’s why I believe Texas will be winning the clean energy transition faster than anyone expects. Without a capacity market, there is no place for fuel based plants to gain investment other than through political means. The price of batteries is going through the floor and Texas has sun and wind in huge capacities. There is going to be a lot of money to be made in electricity arbitrage in Texas and we’re already seeing the benefit of a shift to renewables from the response to the recent cold snap. Change happens gradually, then all at once, and I predict Texas is going to be the indicator for when we are done with gradual change.